Other ways to improve your creditworthiness: Use this option to save money and also raise your AP turnover ratio. Make sure you don’t miss the payment due date! Opt for early payment if it offers you a discountĭiscounts of up to 3% are usually available if you pay early, i.e., within 7 to 10 days of the invoice date. Otherwise, pay just in time, as this maintains a better cash flow. Pay creditors’ bills on timeĭon’t take this to mean that you must pay bills early – certainly not -(unless you want to take advantage of early payment discounts). Improve your Accounts Payable Turnover RatioĪre you suffering from a poor AP turnover ratio? There are some quick ways to improve your creditworthiness and maintain positive credit history. It may also indicate some cash flow issues in your company. It may have a positive connotation – that you have very favourable credit terms with your vendors (probably a reflection of positive credit history with them). Low AP turnover ratioĪ low ratio indicates slow payment or longer intervals in payment to suppliers or vendors.

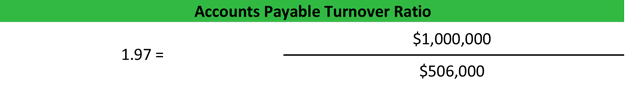

Or it may mean that the company is not reinvesting funds into its business, which may lead to a slower growth rate and lower earnings for the company in the long term. It may indicate that you have very stringent payment terms with vendors (probably because of an unfavourable payment history). However, a high AP Turnover Ratio is not always a positive indicator. Sometimes, a high ratio may indicate that the company is keen to improve its credit rating. Prompt payment to suppliers usually happens either because the suppliers demand quick payment or because they want to avail of early payment discounts. Another helpful tip is to track your industry’s average AP turnover ratio and compare yours to that industry standard. Creditors may notice these patterns and ask for an explanation when evaluating your company’s creditworthiness for a new loan. Sometimes, your AP turnover ratio may show a pattern of consistent highs or lows at certain times of the year. It’s a good idea to keep an eye on how your AP turnover ratio changes over time and understand the reasons for the change. Most accounting experts believe that you must not take the AP turnover ratio at face value-dig deeper to determine why the ratio increases or decreases over time. To summarize, an increasing AP turnover ratio indicates you are paying your bills quickly, and a decreasing AP turnover ratio means you are taking more time to pay off your debts. If you pay it off too quickly, you cannot capitalize on opportunities to invest that money in other initiatives. Yet, it is essential not to do that too fast. Companies usually try to clear their payables regularly to remain creditworthy. So, companies must maintain a healthy AP turnover ratio. If your AP turnover ratio is unfavorableunfavourable, creditors may refrain from extending further credit to you. Simply put, it indicates how many times, on average, a company pays off its suppliers or creditors during a specified accounting period (monthly, quarterly, or annually).Īt a deeper level, the AP turnover ratio indicates to investors whether the business generates enough cash to meet its short-term financial commitments. What does the AP Turnover Ratio indicate? It is a valuable way to identify if a business is facing payment issues and get a sense of its payment history with vendors. In financial modelling, the AP Turnover Ratio is a vital assumption for balance sheet forecasts.Īccountants calculate this ratio by dividing total supplier purchases by the average accounts payable balance for the period. The AP Turnover ratio is also called the creditor’s turnover ratio, and the balance sheet lists it under Current Liabilities. In other words, this ratio functions as a “creditworthiness” rating for a company.

:max_bytes(150000):strip_icc()/AccountsPayableTurnoverRatioFormula-5c76ea8f46e0fb0001a982f1.jpg)

The AP turnover ratio is a short-term liquidity measure used to quantify the rate at which a company pays off its suppliers. That’s where the Accounts Payable (AP) Turnover Ratio comes into the picture. But before we jump into that, let’s understand the AP turnover ratio a bit more in detail. AP automation brings immense benefits and impacts the company’s AP turnover ratio positively. These tend to be tedious, time-consuming and error-prone.

#GOOD ACCOUNTS PAYABLE TURNOVER RATIO MANUAL#

Most accounts payables departments still follow manual processes. “A CFO shouldn’t have to spend one second talking about accounts payable-it should be a process that just happens.”

0 kommentar(er)

0 kommentar(er)